Experience

Seasoned asset managers with a passion for uplifting others through real estate investing opportunities.

LEARN MORE

Education

Build confidence in your ability to invest wisely with the free educational resources

Connection

Stay informed and up to date with the latest investment opportunities and company developments

About us

Christopher Linger and Maricela Soberanes are principals at Up Plex Capital LLC. Accredited Real estate investors. Having built a personal portfolio valued at over $100M, they’ve created significant passive income for themselves and their investors by finding the best properties today’s market can offer. Maricela has a business degree and a successful medical service business since 2015. Chris has an MBA, twenty-seven years of active duty Navy services (ret), now full-time apartment syndicator.

Experience

Seasoned asset managers with a passion for uplifting others through real estate investing opportunities.

Education

Build confidence in your ability to invest wisely with the free educational resources

Connection

Stay informed and up to date with the latest investment opportunities and company developments

Be the First to Know

Receive exclusive investment opportunities, and the latest investing strategies ...right to your inbox.

About Chris and Maricela

Christopher Linger and Maricela Soberanes are principals at Up Plex Capital LLC. Accredited Real estate investors. Having built a personal portfolio valued at over $100M, they’ve created significant passive income for themselves and their investors by finding the best properties today’s market can offer. Maricela has a business degree and a successful medical service business since 2015. Chris has an MBA, twenty-seven years of active-duty Navy services (ret), now full-time apartment syndicator.

Be the First to Know

Receive exclusive investment opportunities, and the latest investing strategies ...right to your inbox.

Hear From Our Investors

My wife and I thank our lucky stars that we worked with Chris and Maricela, they are so organized and always willing to make a win-win situation.

- S. McDonald -

McDonald Homes

I’ve said it before, I’ll say it 100 times. We

owe our success to you both. Great mentors like you [Chris & Maricela] have

helped tremendously!

- S. Enyard -

Anchor Atlas Properties Founder

After seeing and relating to some of my frustrations, they drove two hours to help

with our four-plex renovation. Chris & Maricela are always a wealth of knowledge.

- C. Byler -

Passive Patriots Founder

Low Operational Costs

Facilities require minimal maintenance and management compared to other real estate.

High Profit Margins

Steady cash flow with low overhead leads to strong returns.

Value-Add Opportunities

Simple upgrades like security or climate control can boost income and property value.

Scalability

Easily expand by adding units or acquiring new facilities.

3 Investing Tips

Start Now

The best time to invest in real estate is now and with the right investment, you can see amazing growth in just 18 months.

Trust in Proven Returns

The best time to invest in real estate is now and with the right investment, you can see amazing growth in just 18 months.

Start Just With $50K

It takes less than you think to get started and with the right team you'll shorten your learning curve and increase your returns.

3 Investing Tips

Start Now

The best time to invest in real estate is now and with the right investment, you can see amazing growth in just 18 months.

Trust in Proven Returns

The best time to invest in real estate is now and with the right investment, you can see amazing growth in just 18 months.

Start Just With $50K

It takes less than you think to get started and with the right team you'll shorten your learning curve and increase your returns.

Schedule A Free Consultation

Invest with confidence. We’ll help you understand how to evaluate if a certain asset is right for you.

Schedule A Free Consultation

Invest with confidence. We’ll help you understand how to evaluate if a certain asset is right for you.

Our Assets

We strategically focus on a variety of asset types in order to create a strong and diverse portfolio of assets that can hedge against economic uncertainties. Creating safer investment opportunities for our investors.

Our Assets

We strategically focus on a variety of asset types in order to create a strong and diverse portfolio of assets that can hedge against economic uncertainties. Creating safer investment opportunities for our investors.

FREE Educational

Materials

Learn important investing concepts and strategies at your own pace with our "Savvy Passive Investor" series on YouTube

FREE Educational Materials

Learn important investing concepts and strategies at your own pace with our "Savvy Passive Investor" series on YouTube

Latest News

The Multifamily Market Reset: Challenges & Opportunities

If you’ve been following the multifamily real estate market, you know things have been… a bit of a rollercoaster since 2022. Some investors are feeling the pressure, others are seeing opportunities—but one thing is clear: this is a market that rewards those who stay informed and ready to act.

Here’s the story in simple terms:

Interest rates spiked. The Fed raised rates 11 times in just 16 months, making borrowing more expensive and putting pressure on property values.

Property values dropped. Deals purchased in 2022 are now worth 20%–40% less, and distressed properties—those with low occupancy or high expenses—took an even bigger hit.

Bridge loans are coming due. Many 2022 deals relied on 3-year bridge loans, and as they mature in 2025, owners face a tough choice:

Refinance? That usually means putting in a lot of new money.

Sell? That could lock in big losses—sometimes wiping out the whole investment.

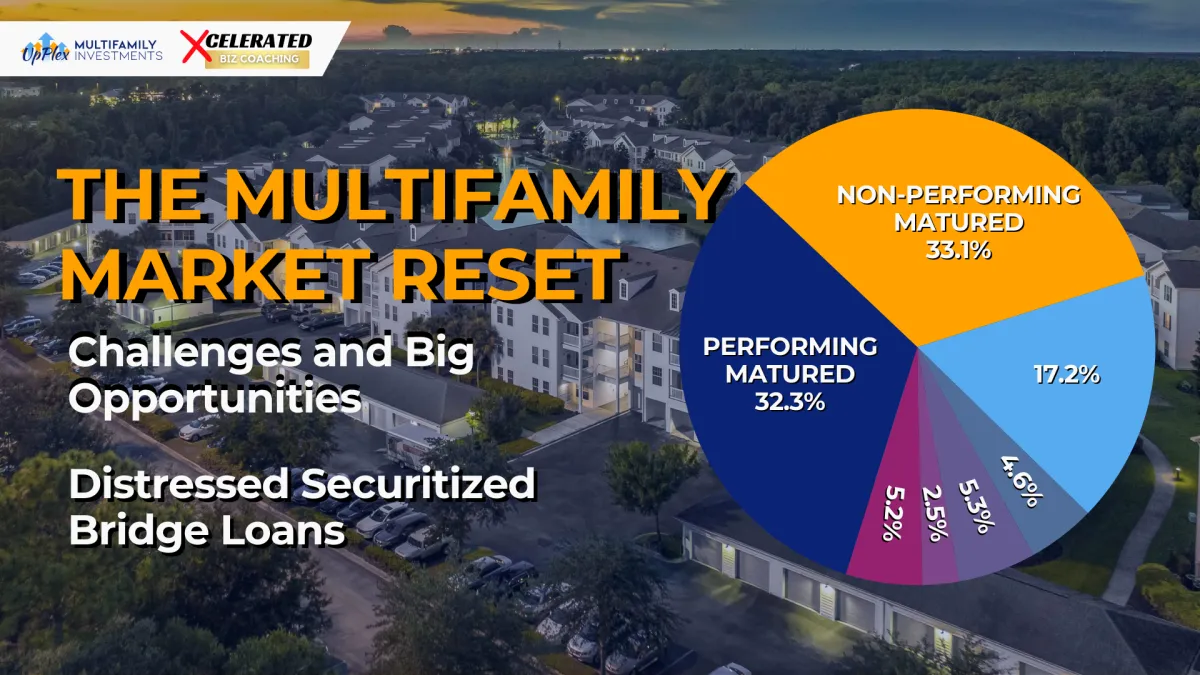

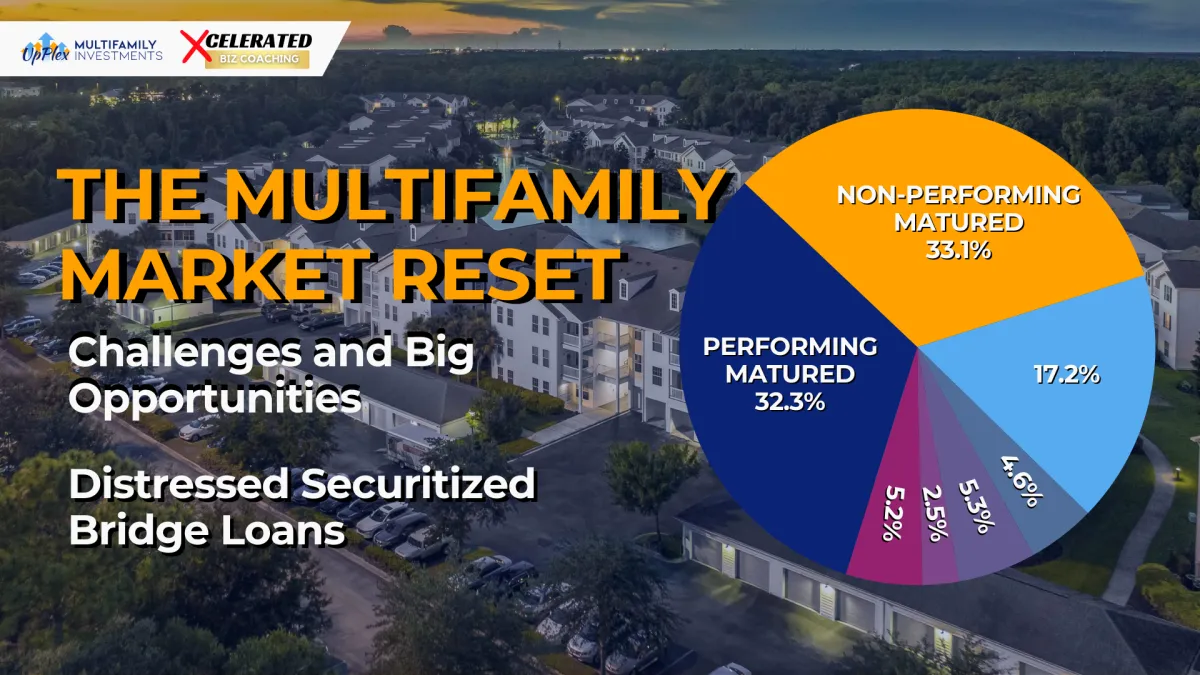

Here’s what the market looks like today

Take a look at the current landscape of distressed bridge loans. The two largest slices—red and purple—make up almost two-thirds of the market:

Performing Matured (blue – 32.3%): Loans that have expired but are still being paid while lenders hold off on calling the principal.

Non-Performing Matured (orange – 33.1%): Loans that have expired, borrowers stopped paying, and lenders haven’t enforced repayment yet.

In other words, a lot of owners are stuck. They can’t refinance easily, and selling now might mean taking a big hit.

So… what does this mean for investors?

Here’s the exciting part: this environment is tough for current owners—but for disciplined investors, it creates opportunities you don’t see every day:

Forced sales = discounted deals. Sellers who have to move quickly are offering high-quality properties at lower prices.

Downturns = wealth-building windows. Some of the biggest fortunes in real estate were built during periods like this, when others were forced to exit.

Diversification protects you. Spreading capital across multiple deals, property types (multifamily, storage, MHPs, notes), and locations reduces risk while keeping your options open.

Whether you’re experienced, just getting started, or somewhere in between, this is a time to stay alert, think strategically, and have capital ready.

The bottom line

The current multifamily market isn’t the end—it’s a reset. Investors who are ready, patient, and diversified will be positioned to capture the upside when stability returns. As Warren Buffett reminds us: “Be fearful when others are greedy, and greedy when others are fearful.” Right now? It’s a window where disciplined investors can take advantage while others are stuck.

Want to see how this plays out in real time?

Join us for our Monthly Investor Webinar:

1️⃣ Investor Webinar: Deep Dive on a New Real Estate Opportunity

📅 Saturday, September 13, 2025 | ⏰ 4:00 PM ET

In this session, we’ll break down a current investment opportunity in detail. You’ll learn:

Deal snapshot: market, asset profile, and value-creation plan

Financials: assumptions, projected returns, risk factors

Capital stack & use of funds

Timeline: due diligence → close → execution milestones

Investor experience: minimums, distributions, reporting, and tax docs

📎 You’ll also receive: the investment summary deck (PDF), replay link, and next-step checklist.

Registration link - https://us02web.zoom.us/webinar/register/WN_kXISIvqTQdOV6JoW8EyvBg

2️⃣ Monthly Virtual Meetup: Real Estate Basics + Hacks & Case Studies

📅 Thursday, September 18, 2025 | ⏰ 7:00 PM CT

Ever wish you could see exactly how real estate investors are building passive income—step by step? This meetup is your behind-the-scenes look at proven strategies being used today.

What you can expect:

Real case studies (no fluff, just results)

Straightforward breakdowns of what works and why

Tips to avoid common mistakes and fast-track your success

This is for you if:

You’re new to real estate and want a clear path forward

You’ve started learning but need guidance you can trust

You’re ready to take action, not just take notes

✅ Take the guesswork out of real estate investing. Learn what’s working—and how to apply it right away. Register now to secure your spot.

Registration link - https://us02web.zoom.us/webinar/register/WN_np9PLr5URva1ftp6zLrL_g

🚀 Ready to take the next step? Don’t just watch the market—position yourself to benefit from it. Register now!

LEAVE A REPLY

Check Out Our Latest BLOG Post

The Multifamily Market Reset: Challenges & Opportunities

If you’ve been following the multifamily real estate market, you know things have been… a bit of a rollercoaster since 2022. Some investors are feeling the pressure, others are seeing opportunities—but one thing is clear: this is a market that rewards those who stay informed and ready to act.

Here’s the story in simple terms:

Interest rates spiked. The Fed raised rates 11 times in just 16 months, making borrowing more expensive and putting pressure on property values.

Property values dropped. Deals purchased in 2022 are now worth 20%–40% less, and distressed properties—those with low occupancy or high expenses—took an even bigger hit.

Bridge loans are coming due. Many 2022 deals relied on 3-year bridge loans, and as they mature in 2025, owners face a tough choice:

Refinance? That usually means putting in a lot of new money.

Sell? That could lock in big losses—sometimes wiping out the whole investment.

Here’s what the market looks like today

Take a look at the current landscape of distressed bridge loans. The two largest slices—red and purple—make up almost two-thirds of the market:

Performing Matured (blue – 32.3%): Loans that have expired but are still being paid while lenders hold off on calling the principal.

Non-Performing Matured (orange – 33.1%): Loans that have expired, borrowers stopped paying, and lenders haven’t enforced repayment yet.

In other words, a lot of owners are stuck. They can’t refinance easily, and selling now might mean taking a big hit.

So… what does this mean for investors?

Here’s the exciting part: this environment is tough for current owners—but for disciplined investors, it creates opportunities you don’t see every day:

Forced sales = discounted deals. Sellers who have to move quickly are offering high-quality properties at lower prices.

Downturns = wealth-building windows. Some of the biggest fortunes in real estate were built during periods like this, when others were forced to exit.

Diversification protects you. Spreading capital across multiple deals, property types (multifamily, storage, MHPs, notes), and locations reduces risk while keeping your options open.

Whether you’re experienced, just getting started, or somewhere in between, this is a time to stay alert, think strategically, and have capital ready.

The bottom line

The current multifamily market isn’t the end—it’s a reset. Investors who are ready, patient, and diversified will be positioned to capture the upside when stability returns. As Warren Buffett reminds us: “Be fearful when others are greedy, and greedy when others are fearful.” Right now? It’s a window where disciplined investors can take advantage while others are stuck.

Want to see how this plays out in real time?

Join us for our Monthly Investor Webinar:

1️⃣ Investor Webinar: Deep Dive on a New Real Estate Opportunity

📅 Saturday, September 13, 2025 | ⏰ 4:00 PM ET

In this session, we’ll break down a current investment opportunity in detail. You’ll learn:

Deal snapshot: market, asset profile, and value-creation plan

Financials: assumptions, projected returns, risk factors

Capital stack & use of funds

Timeline: due diligence → close → execution milestones

Investor experience: minimums, distributions, reporting, and tax docs

📎 You’ll also receive: the investment summary deck (PDF), replay link, and next-step checklist.

Registration link - https://us02web.zoom.us/webinar/register/WN_kXISIvqTQdOV6JoW8EyvBg

2️⃣ Monthly Virtual Meetup: Real Estate Basics + Hacks & Case Studies

📅 Thursday, September 18, 2025 | ⏰ 7:00 PM CT

Ever wish you could see exactly how real estate investors are building passive income—step by step? This meetup is your behind-the-scenes look at proven strategies being used today.

What you can expect:

Real case studies (no fluff, just results)

Straightforward breakdowns of what works and why

Tips to avoid common mistakes and fast-track your success

This is for you if:

You’re new to real estate and want a clear path forward

You’ve started learning but need guidance you can trust

You’re ready to take action, not just take notes

✅ Take the guesswork out of real estate investing. Learn what’s working—and how to apply it right away. Register now to secure your spot.

Registration link - https://us02web.zoom.us/webinar/register/WN_np9PLr5URva1ftp6zLrL_g

🚀 Ready to take the next step? Don’t just watch the market—position yourself to benefit from it. Register now!

LEAVE A REPLY