Experience

Seasoned asset managers with a passion for uplifting others through real estate investing opportunities.

LEARN MORE

Education

Build confidence in your ability to invest wisely with the free educational resources

Connection

Stay informed and up to date with the latest investment opportunities and company developments

About us

Christopher Linger and Maricela Soberanes are principals at Up Plex Capital LLC. Accredited Real estate investors. Having built a personal portfolio valued at over $100M, they’ve created significant passive income for themselves and their investors by finding the best properties today’s market can offer. Maricela has a business degree and a successful medical service business since 2015. Chris has an MBA, twenty-seven years of active duty Navy services (ret), now full-time apartment syndicator.

Experience

Seasoned asset managers with a passion for uplifting others through real estate investing opportunities.

Education

Build confidence in your ability to invest wisely with the free educational resources

Connection

Stay informed and up to date with the latest investment opportunities and company developments

Be the First to Know

Receive exclusive investment opportunities, and the latest investing strategies ...right to your inbox.

About Chris and Maricela

Christopher Linger and Maricela Soberanes are principals at Up Plex Capital LLC. Accredited Real estate investors. Having built a personal portfolio valued at over $100M, they’ve created significant passive income for themselves and their investors by finding the best properties today’s market can offer. Maricela has a business degree and a successful medical service business since 2015. Chris has an MBA, twenty-seven years of active-duty Navy services (ret), now full-time apartment syndicator.

Be the First to Know

Receive exclusive investment opportunities, and the latest investing strategies ...right to your inbox.

Hear From Our Investors

My wife and I thank our lucky stars that we worked with Chris and Maricela, they are so organized and always willing to make a win-win situation.

- S. McDonald -

McDonald Homes

I’ve said it before, I’ll say it 100 times. We

owe our success to you both. Great mentors like you [Chris & Maricela] have

helped tremendously!

- S. Enyard -

Anchor Atlas Properties Founder

After seeing and relating to some of my frustrations, they drove two hours to help

with our four-plex renovation. Chris & Maricela are always a wealth of knowledge.

- C. Byler -

Passive Patriots Founder

Low Operational Costs

Facilities require minimal maintenance and management compared to other real estate.

High Profit Margins

Steady cash flow with low overhead leads to strong returns.

Value-Add Opportunities

Simple upgrades like security or climate control can boost income and property value.

Scalability

Easily expand by adding units or acquiring new facilities.

3 Investing Tips

Start Now

The best time to invest in real estate is now and with the right investment, you can see amazing growth in just 18 months.

Trust in Proven Returns

The best time to invest in real estate is now and with the right investment, you can see amazing growth in just 18 months.

Start Just With $50K

It takes less than you think to get started and with the right team you'll shorten your learning curve and increase your returns.

3 Investing Tips

Start Now

The best time to invest in real estate is now and with the right investment, you can see amazing growth in just 18 months.

Trust in Proven Returns

The best time to invest in real estate is now and with the right investment, you can see amazing growth in just 18 months.

Start Just With $50K

It takes less than you think to get started and with the right team you'll shorten your learning curve and increase your returns.

Schedule A Free Consultation

Invest with confidence. We’ll help you understand how to evaluate if a certain asset is right for you.

Schedule A Free Consultation

Invest with confidence. We’ll help you understand how to evaluate if a certain asset is right for you.

Our Assets

We strategically focus on a variety of asset types in order to create a strong and diverse portfolio of assets that can hedge against economic uncertainties. Creating safer investment opportunities for our investors.

Our Assets

We strategically focus on a variety of asset types in order to create a strong and diverse portfolio of assets that can hedge against economic uncertainties. Creating safer investment opportunities for our investors.

FREE Educational

Materials

Learn important investing concepts and strategies at your own pace with our "Savvy Passive Investor" series on YouTube

FREE Educational Materials

Learn important investing concepts and strategies at your own pace with our "Savvy Passive Investor" series on YouTube

Latest News

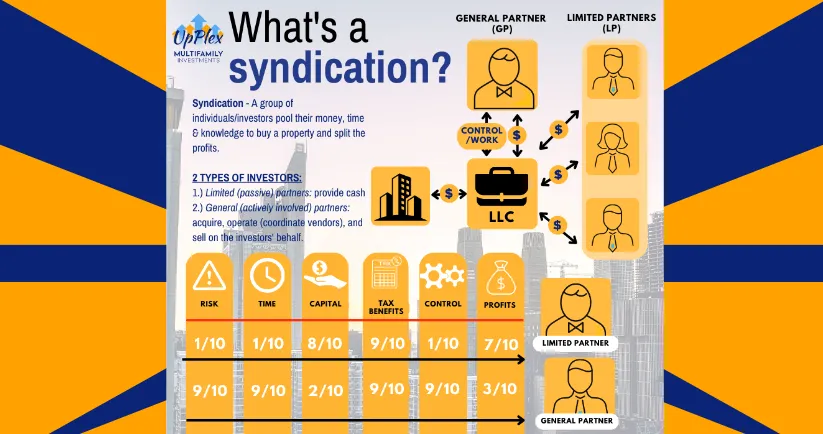

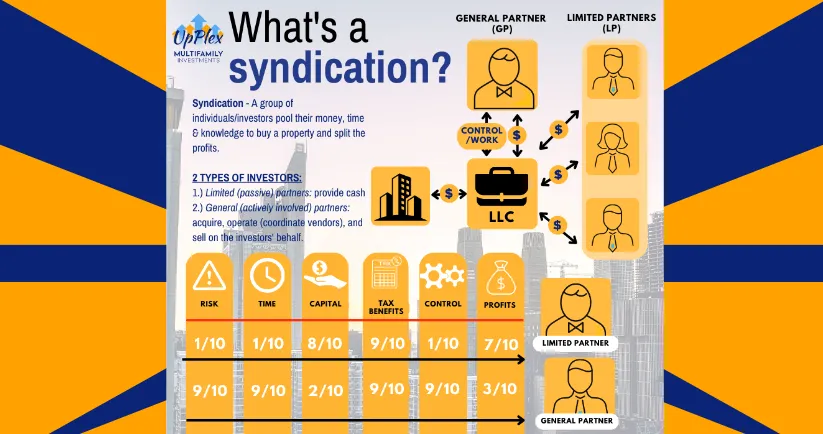

What is an Apartment Syndication?

Real estate investing can be a great way to build wealth and generate passive income. One of the most popular types of real estate investing in multifamily properties. These properties, such as apartment buildings are considered to be the most easy to scale model in the industry.

One of the main reasons why multifamily properties are considered to be easy to scale is due to the economies of scale. When you own a multifamily property, you are able to generate income from multiple units at once. This allows you to spread out the costs of maintenance and management, making it more cost-effective than owning single-family homes. Additionally, multifamily properties can generate a higher return on investment compared to single-family homes because of the higher rental income.

Another reason why multifamily properties are considered to be easy to scale is that they offer more stability. Tenants in multifamily properties tend to stay for longer periods of time, which reduces turnover and vacancy rates. This stability can help to provide a more consistent income stream for the investor.

Multifamily properties also offer more opportunities for appreciation. As the population in an area grows, the demand for rental housing also increases, which can drive up rental prices and property values. This can provide a significant return on investment for the investor.

Moreover, when investing in multifamily properties, investors have the option to invest passively through a syndication. This allows them to invest in the property without the hassles of managing it. Instead, the management of the property is handled by the syndicator who is an experienced real estate professional. This is a great way for investors to take advantage of the benefits of multifamily properties without the need to manage the property themselves.

SO WHAT IS AN APARTMENT SYNDICATION?

Apartment syndication is a type of real estate investment strategy that allows multiple investors to pool their resources together to purchase and manage a larger apartment complex. This type of investment allows individual investors to participate in a larger commercial real estate venture that they may not have been able to afford on their own.

The process of apartment syndication begins with the identification of a suitable apartment complex for purchase. Once the complex is identified, the syndicator, who is typically an experienced real estate investor, will work to raise capital from a group of individual investors. These investors will typically be accredited, meaning they meet certain income and net worth requirements set by the Securities and Exchange Commission (SEC).

Once the capital is raised, the syndicator will use the funds to purchase the apartment complex. The syndicator will also be responsible for managing the day-to-day operations of the complex, including leasing, maintenance, and finances. The individual investors, known as syndicate members, will be passive investors who provide capital but do not actively manage the property.

One of the main benefits of apartment syndication is the potential for high returns on investment. Because the syndicator is able to purchase a larger property than an individual investor could on their own, there is the potential for higher rental income and appreciation in value. Additionally, the syndicator’s expertise in managing the property can lead to improved operations and increased revenue.

However, there are also risks associated with apartment syndication. As with any real estate investment, there is the potential for the property to lose value, and the investor’s capital may be at risk. It is important for individual investors to do their due diligence and thoroughly research the syndicator and the property before investing.

In conclusion, apartment syndication is a way for individual investors to pool their resources together and participate in a larger commercial real estate venture. It offers the potential for high returns, but it also comes with risks. As with any investment, it is important to thoroughly research the opportunity and understand the potential risks before investing. Multifamily properties are considered to be the most easy to scale model in the real estate industry due to their cost-effectiveness, stability, potential for appreciation, and opportunity for passive investment through syndication.

They offer a more consistent income stream, higher returns on investment, and a more stable property market compared to single-family homes. For these reasons, multifamily properties are a popular choice for real estate investors looking to build wealth and generate passive income.

If you want to know if investing passively is for you, book a FREE consultation now!

LEAVE A REPLY

Check Out Our Latest BLOG Post

What is an Apartment Syndication?

Real estate investing can be a great way to build wealth and generate passive income. One of the most popular types of real estate investing in multifamily properties. These properties, such as apartment buildings are considered to be the most easy to scale model in the industry.

One of the main reasons why multifamily properties are considered to be easy to scale is due to the economies of scale. When you own a multifamily property, you are able to generate income from multiple units at once. This allows you to spread out the costs of maintenance and management, making it more cost-effective than owning single-family homes. Additionally, multifamily properties can generate a higher return on investment compared to single-family homes because of the higher rental income.

Another reason why multifamily properties are considered to be easy to scale is that they offer more stability. Tenants in multifamily properties tend to stay for longer periods of time, which reduces turnover and vacancy rates. This stability can help to provide a more consistent income stream for the investor.

Multifamily properties also offer more opportunities for appreciation. As the population in an area grows, the demand for rental housing also increases, which can drive up rental prices and property values. This can provide a significant return on investment for the investor.

Moreover, when investing in multifamily properties, investors have the option to invest passively through a syndication. This allows them to invest in the property without the hassles of managing it. Instead, the management of the property is handled by the syndicator who is an experienced real estate professional. This is a great way for investors to take advantage of the benefits of multifamily properties without the need to manage the property themselves.

SO WHAT IS AN APARTMENT SYNDICATION?

Apartment syndication is a type of real estate investment strategy that allows multiple investors to pool their resources together to purchase and manage a larger apartment complex. This type of investment allows individual investors to participate in a larger commercial real estate venture that they may not have been able to afford on their own.

The process of apartment syndication begins with the identification of a suitable apartment complex for purchase. Once the complex is identified, the syndicator, who is typically an experienced real estate investor, will work to raise capital from a group of individual investors. These investors will typically be accredited, meaning they meet certain income and net worth requirements set by the Securities and Exchange Commission (SEC).

Once the capital is raised, the syndicator will use the funds to purchase the apartment complex. The syndicator will also be responsible for managing the day-to-day operations of the complex, including leasing, maintenance, and finances. The individual investors, known as syndicate members, will be passive investors who provide capital but do not actively manage the property.

One of the main benefits of apartment syndication is the potential for high returns on investment. Because the syndicator is able to purchase a larger property than an individual investor could on their own, there is the potential for higher rental income and appreciation in value. Additionally, the syndicator’s expertise in managing the property can lead to improved operations and increased revenue.

However, there are also risks associated with apartment syndication. As with any real estate investment, there is the potential for the property to lose value, and the investor’s capital may be at risk. It is important for individual investors to do their due diligence and thoroughly research the syndicator and the property before investing.

In conclusion, apartment syndication is a way for individual investors to pool their resources together and participate in a larger commercial real estate venture. It offers the potential for high returns, but it also comes with risks. As with any investment, it is important to thoroughly research the opportunity and understand the potential risks before investing. Multifamily properties are considered to be the most easy to scale model in the real estate industry due to their cost-effectiveness, stability, potential for appreciation, and opportunity for passive investment through syndication.

They offer a more consistent income stream, higher returns on investment, and a more stable property market compared to single-family homes. For these reasons, multifamily properties are a popular choice for real estate investors looking to build wealth and generate passive income.

If you want to know if investing passively is for you, book a FREE consultation now!

LEAVE A REPLY