La misión de Up Plex

Elevar a otros brindándoles oportunidades de inversión pasiva y generación de riqueza a través del sector inmobiliario.

Es un hecho conocido que poseer bienes raíces puede ser uno de los mejores vehículos de inversión pasiva para usted. Más específicamente, edificios de apartamentos y bienes raíces comerciales. Sin embargo, también conlleva una increíble cantidad de complejidades al intentar adquirir dichos activos y hemos descubierto que esa es la razón por la que la mayoría de los inversores principiantes se abstienen de intentarlo.

Por eso, nos propusimos hacer que sea más alcanzable para los inversores invertir en estos increíbles activos generadores de riqueza con confianza. Como socio limitado, puede aprovechar nuestro tiempo, red y décadas de experiencia para generar tranquilidad con cada inversión que realice con nosotros. Hacemos todo lo posible para mitigar la mayor cantidad de riesgos posible. Tanto es así que no ofreceremos una oportunidad en la que no estemos invirtiendo nosotros mismos.

The Up Plex Mission

Elevating others by providing wealth-building, passive investment opportunities through real estate.

It’s a known fact that owning real estate can be one of the best passive investment vehicles for you. More specifically, apartment buildings and commercial real estate. However, it also comes with an incredible amount of complexities in trying to acquire such assets and we’ve found that to be the reason most beginner investors shy away from pursuing.

So we set out to make it more attainable for investors to invest in these incredible wealth-building assets with confidence. As a limited partner, you get to leverage our time, network, and decades of experience to create peace of mind with every investment you make with us. We do our best to mitigate as much risk as possible. So much so that we won’t offer an opportunity that we aren’t investing in ourselves.

Chris Linger

Principal

Chris Linger has an MBA, twenty seven years of active duty Navy services (ret), now full-time apartment syndicator (underwriter and asset management). Mentor to hundreds of aspiring investors.

Maricela Soberanes

Principal

Maricela has been investing in Real Estate since 2006 in Austin TX. She successfully grew a personal rental portfolio before becoming a full-time syndicator. She’s a Navy veteran, self-published author, and a medical missionary to third world countries.

Chris Linger

Principal

Chris Linger tiene un MBA, veintisiete años de servicio activo en la Marina (retirado) y ahora trabaja a tiempo completo como agente de consorcio inmobiliario (suscriptor y administrador de activos). Es mentor de cientos de aspirantes a inversores.

Maricela Soberanes

Principal

Maricela ha estado invirtiendo en bienes raíces desde 2006 en Austin, Texas. Hizo crecer con éxito una cartera personal de alquiler antes de convertirse en distribuidora a tiempo completo. Es una veterana de la Marina, autora autopublicada y misionera médica en países del tercer mundo.

Our Success Formula

Underwriting & Negotiating

Detailed underwriting determines the amount of negotiating that can be done with a seller on price and terms. Our experience allows us to properly analyze an asset and mitigate as much risk as possible for our investors.

Contract Review / Due Diligence

We have established the best legal and due diligence teams for our syndications. This allows us to simultaneously expedite two incredibly time-consuming tasks that most beginning investors struggle with.

Closing & Reassessment

There is more to closing than just signing on the dotted line and handing over the keys. There is an equal amount of critical work that needs to be completed soon after to ensure the success of a syndication.

Enacting Business Plan / CapEx

We identify and prioritize the necessary projects and execute them based on funding and critical need. Simultaneously, our expert CapEx team gets to work by coordinating with asset and property managers to assist in stabilizing the property.

Stabilization / Refinance

This process usually takes just over 2 years (depending on the market) and involves everything from completing CapEx, to ensuring organic fair market rent growth, to managing tenant turnover, all while working to decrease expenses.

Sale/Disposition

When it comes time to sell, we prepare the property to show as cost-effectively as possible. Once sold, we ensure that we properly close out business transactions and 3 months after the sale, we deliver all sales proceeds (return of capital) to our investors.

Nuestra fórmula del éxito

Suscripción y negociación

La suscripción detallada determina el grado de negociación que se puede realizar con un vendedor sobre el precio y las condiciones. Nuestra experiencia nos permite analizar adecuadamente un activo y mitigar el mayor riesgo posible para nuestros inversores.

Revisión de contrato / diligencia debida

Hemos creado los mejores equipos legales y de due diligence para nuestras sindicaciones. Esto nos permite agilizar simultáneamente dos tareas que consumen muchísimo tiempo y con las que la mayoría de los inversores principiantes tienen dificultades.

Cierre y reevaluación

El cierre implica mucho más que simplemente firmar en la línea de puntos y entregar las llaves. Hay una cantidad igual de trabajo crítico que debe completarse poco después para garantizar el éxito de una sindicación.

Implementación del plan de negocios / CapEx

Identificamos y priorizamos los proyectos necesarios y los ejecutamos en función de la financiación y la necesidad crítica. Al mismo tiempo, nuestro equipo experto en gastos de capital se pone a trabajar en coordinación con los administradores de activos y propiedades para ayudar a estabilizar la propiedad.

Estabilización / Refinanciación

Este proceso suele tardar un poco más de 2 años (dependiendo del mercado) e implica todo, desde completar el CapEx, hasta asegurar un crecimiento orgánico y justo del alquiler en el mercado, hasta gestionar la rotación de inquilinos, todo mientras se trabaja para reducir los gastos.

Venta/Disposición

Cuando llega el momento de vender, preparamos la propiedad para mostrarla de la forma más rentable posible. Una vez vendida, nos aseguramos de cerrar adecuadamente las transacciones comerciales y, 3 meses después de la venta, entregamos todos los ingresos de la venta (retorno de capital) a nuestros inversores.

The Numbers

Don't Lie

$100M

PORTFOLIO

UNDER MANAGEMENT

2500+

DOORS

2006

INVESTING SINCE

5

INVESTED IN MARKETS

(FL, AZ, TX, PA, OH)

The Numbers Don't Lie

$100M

PORTFOLIO

UNDER MANAGEMENT

2500+

DOORS

2006

INVESTING SINCE

5

INVESTED IN MARKETS

(FL, AZ, TX, PA, OH)

Vea Nuestro Último Blog

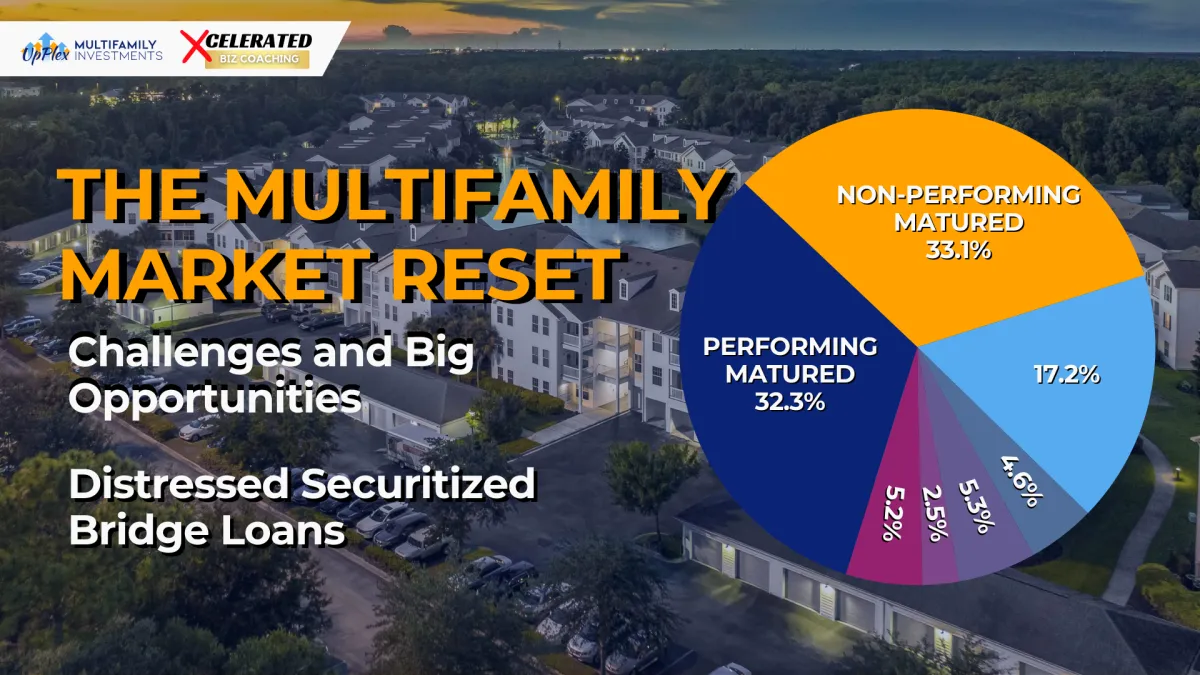

The Multifamily Market Reset: Challenges & Opportunities

If you’ve been following the multifamily real estate market, you know things have been… a bit of a rollercoaster since 2022. Some investors are feeling the pressure, others are seeing opportunities—but one thing is clear: this is a market that rewards those who stay informed and ready to act.

Here’s the story in simple terms:

Interest rates spiked. The Fed raised rates 11 times in just 16 months, making borrowing more expensive and putting pressure on property values.

Property values dropped. Deals purchased in 2022 are now worth 20%–40% less, and distressed properties—those with low occupancy or high expenses—took an even bigger hit.

Bridge loans are coming due. Many 2022 deals relied on 3-year bridge loans, and as they mature in 2025, owners face a tough choice:

Refinance? That usually means putting in a lot of new money.

Sell? That could lock in big losses—sometimes wiping out the whole investment.

Here’s what the market looks like today

Take a look at the current landscape of distressed bridge loans. The two largest slices—red and purple—make up almost two-thirds of the market:

Performing Matured (blue – 32.3%): Loans that have expired but are still being paid while lenders hold off on calling the principal.

Non-Performing Matured (orange – 33.1%): Loans that have expired, borrowers stopped paying, and lenders haven’t enforced repayment yet.

In other words, a lot of owners are stuck. They can’t refinance easily, and selling now might mean taking a big hit.

So… what does this mean for investors?

Here’s the exciting part: this environment is tough for current owners—but for disciplined investors, it creates opportunities you don’t see every day:

Forced sales = discounted deals. Sellers who have to move quickly are offering high-quality properties at lower prices.

Downturns = wealth-building windows. Some of the biggest fortunes in real estate were built during periods like this, when others were forced to exit.

Diversification protects you. Spreading capital across multiple deals, property types (multifamily, storage, MHPs, notes), and locations reduces risk while keeping your options open.

Whether you’re experienced, just getting started, or somewhere in between, this is a time to stay alert, think strategically, and have capital ready.

The bottom line

The current multifamily market isn’t the end—it’s a reset. Investors who are ready, patient, and diversified will be positioned to capture the upside when stability returns. As Warren Buffett reminds us: “Be fearful when others are greedy, and greedy when others are fearful.” Right now? It’s a window where disciplined investors can take advantage while others are stuck.

Want to see how this plays out in real time?

Join us for our Monthly Investor Webinar:

1️⃣ Investor Webinar: Deep Dive on a New Real Estate Opportunity

📅 Saturday, September 13, 2025 | ⏰ 4:00 PM ET

In this session, we’ll break down a current investment opportunity in detail. You’ll learn:

Deal snapshot: market, asset profile, and value-creation plan

Financials: assumptions, projected returns, risk factors

Capital stack & use of funds

Timeline: due diligence → close → execution milestones

Investor experience: minimums, distributions, reporting, and tax docs

📎 You’ll also receive: the investment summary deck (PDF), replay link, and next-step checklist.

Registration link - https://us02web.zoom.us/webinar/register/WN_kXISIvqTQdOV6JoW8EyvBg

2️⃣ Monthly Virtual Meetup: Real Estate Basics + Hacks & Case Studies

📅 Thursday, September 18, 2025 | ⏰ 7:00 PM CT

Ever wish you could see exactly how real estate investors are building passive income—step by step? This meetup is your behind-the-scenes look at proven strategies being used today.

What you can expect:

Real case studies (no fluff, just results)

Straightforward breakdowns of what works and why

Tips to avoid common mistakes and fast-track your success

This is for you if:

You’re new to real estate and want a clear path forward

You’ve started learning but need guidance you can trust

You’re ready to take action, not just take notes

✅ Take the guesswork out of real estate investing. Learn what’s working—and how to apply it right away. Register now to secure your spot.

Registration link - https://us02web.zoom.us/webinar/register/WN_np9PLr5URva1ftp6zLrL_g

🚀 Ready to take the next step? Don’t just watch the market—position yourself to benefit from it. Register now!

LEAVE A REPLY

Gestores de activos dedicados a ayudar a otros a través de la educación sobre creación de riqueza y la inversión pasiva a través de bienes raíces.

CARTERA DE ACTIVOS

Copyright © 2022 Up Plex Multifamily All rights reserved.

Our Success Formula

Deatiled breakdown

Underwriting & Negotiating

Contract Review / Due Diligence

Closing & Reassessment

Enacting Business Plan / CapEx

Stabilization / Refinance

Sale / Disposition

Underwriting & Negotiating

When you invest with UpPlex, you can be sure that the passive investor opportunities we offer are thoroughly vetted by our experienced legal and due diligence teams. The right legal team is imperative for streamlining the processes of establishing contracts, preparing SEC filings, vendor contract reviews, and more. Just as important is our due diligence team. They analyze CapEx, rent rolls, market demographics, job/population growth, lease agreements, profit and loss statements, financials, and more. Both teams require highly specialized professionals in order to help us quickly determine if an asset is worth continuing to pursue once we have it under contract. This in turn allows us to continue looking for other opportunities that we can provide to our investors

Latest News

Exploring Investment 506(c) and 506(b) Offerings: Unveiling the Path to Private Investments

Date 16 June 2023 / Comment 0

In the realm of investment opportunities, there are several ways to raise capital, each having their own rules and criteria. In the United States, two well-known choices for private investments are the 506(c) offering and the 506(b) offering. In this blog, we will explore the qualities, distinctions, and advantages of these two investment options. Therefore, […]

The Power of Diversification

Date 20 May 2023 / Comment 0

Diversification in Real Estate Assets: Real estate has long been considered a stable and lucrative investment avenue. Investors have traditionally focused on residential and commercial properties, but the world of real estate investing has expanded significantly in recent years. One strategy that has gained prominence is diversification in real estate assets. In this blog post, […]

(Español) Razones para invertir en sindicaciones de apartamentos: Flujo de caja vs Equidad vs Apreciación

Date 5 May 2023 / Comment 0

Sorry, this entry is only available in Español.

Asset managers dedicated to elevating others through education in wealth-creation, and passive investing through real estate.

ASSET PORTFOLIO